In today’s economic climate, finding effective ways to save money is more important than ever. Whether you’re saving for a big purchase, planning for retirement, or simply trying to make your budget work, tips for saving money monthly can make a significant difference. This article will explore practical strategies and tips that anyone can implement to enhance their financial stability by saving more each month.

Analyze Your Current Expenses

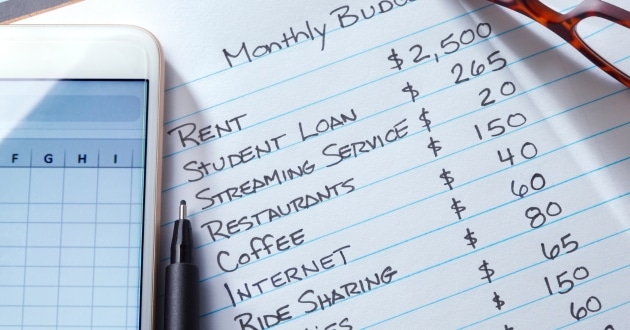

Before you can start saving effectively, it’s crucial to understand where your money goes. Start by categorizing your spending into essentials (rent, utilities, groceries) and non-essentials (dining out, entertainment). Use apps or spreadsheets to track your spending for at least one month.

| Category | Percentage of Income |

|---|---|

| Housing | 30% |

| Food | 15% |

| Transportation | 10% |

| Utilities | 5% |

| Entertainment | 5% |

| Savings | 10% |

| Miscellaneous | 25% |

Effective Saving Strategies

Set Clear Financial Goals

Start by setting specific, measurable, achievable, relevant, and time-bound (SMART) goals. For example, saving $1,000 for an emergency fund in six months.

Automate Your Savings

One of the easiest ways to ensure you save consistently is to automate it. Set up automatic transfers from your checking account to a savings account every payday.

Reduce Monthly Bills

Look for ways to reduce recurring monthly costs. Consider negotiating bills like insurance, subscriptions, and phone plans. Even a small reduction can add up over time.

| Bill Type | Current Cost | Reduced Cost | Monthly Savings |

|---|---|---|---|

| Phone Bill | $75 | $60 | $15 |

| Gym Membership | $50 | $40 | $10 |

| Subscription Box | $30 | $20 | $10 |

Cut Down on Non-Essential Spending

Identify non-essential expenses that you can reduce or eliminate. For example, dining out less frequently or opting for less expensive entertainment options.

Embrace DIY Projects

Engaging in DIY projects can be a fun and cost-effective way to save. Whether it’s home repairs, gardening, or crafting, doing it yourself can reduce expenses significantly.

Smart Investing to Boost Your Savings

Dive into the world of investments without fear! We’ll start with the basics of low-risk investments, perfect for beginners. Learn how simple choices can help your savings flourish through the magic of compound interest. Imagine turning small savings into a significant nest egg!

Turn Every Purchase into a Saving Opportunity

Who says spending can’t be rewarding? Master the art of maximizing rewards and cash-back from your everyday purchases. From picking the right credit cards to joining the best loyalty programs, learn how to make your money work for you even when you’re spending it.

Shop Smart: Seasonal Sales and Bulk Buys

Get insider tips on the best times to buy everything from electronics to clothing and even groceries. Understand the rhythm of retail sales cycles and unlock the secrets of bulk buying. Saving big might just be about buying at the right time and in the right quantity!

Green Choices that Save Green

Embrace a lifestyle that’s not only eco-friendly but also wallet-friendly. Discover how simple changes, like opting for energy-efficient appliances or biking to work, can drastically reduce your bills and improve your health and the planet.

Investing Your Savings: Make Your Money Work for You

Once you’ve started saving money monthly, the next step is to make your savings grow through smart investments. Investing can seem intimidating at first, but it doesn’t have to be. With the right tools and resources, you can easily begin investing and see your money work for you.

One excellent resource to help you get started is Acorns. Acorns is a user-friendly investment platform that helps you invest spare change from everyday purchases. By rounding up your transactions to the nearest dollar and investing the difference, Acorns makes it easy to build an investment portfolio without needing a large upfront capital. This automated approach can help you steadily grow your savings over time, making it an excellent option for new and experienced investors alike.

Financial Planning Made Easy

Think a financial advisor is a luxury? Think again! We’ll show you how getting professional advice can be a game-changer for your financial health. Plus, explore the latest intuitive budgeting tools and apps that make managing money a breeze.

The Mindful Spending Movement

Join the movement of mindful spending and kick impulse buys to the curb. Learn how to evaluate your spending habits, understand the psychology behind impulse purchases, and appreciate the true value of your money. It’s not just about spending less, but spending right.

Certainly! Here’s the revised FAQ section with proper heading formatting for better readability in a blog post:

Tackling Debt: Best Ways to Reduce Personal Debt

One of the most effective strategies for improving your monthly savings is to tackle personal debt head-on. High-interest debts can quickly erode your savings, making it essential to find the best ways to reduce personal debt. By managing and reducing your debt, you can free up more of your income for savings and other financial goals.

For comprehensive strategies and tips on how to effectively reduce your debt, visit this best ways to reduce personal debt guide. It covers practical methods to manage and pay down your debt, ultimately helping you achieve a more stable financial future.

FAQ: Tips for Saving Money Monthly

How much of my income should I save each month?

A common rule of thumb is the 50/30/20 rule, where 20% of your income goes towards savings. However, this can vary based on your financial goals and expenses.

What are the best tools for tracking my spending?

Apps like Mint, YNAB (You Need A Budget), and PocketGuard are popular for their user-friendly interfaces and comprehensive budgeting features.

Is it better to pay off debt or save money?

Ideally, both. Prioritize high-interest debt, but also set aside a small amount for emergencies, even if it’s just a few dollars each month.

How can I save money on groceries?

Plan meals, use coupons, buy in bulk, and shop for generic brands. Also, try to minimize food waste by only buying what you need.

What are some effective ways to reduce monthly bills?

Negotiate lower rates for services like internet and cable, switch to more cost-effective providers, and unplug appliances when not in use to save on electricity.

Can automated savings tools really help me save?

Yes, automated tools help by transferring a predetermined amount from checking to savings each month, making the process effortless and ensuring you save consistently.

What should I do if I can’t stick to my savings goals?

Review and adjust your goals to make them more realistic. Also, consider identifying and cutting non-essential expenses to free up more money for savings.

Are there benefits to saving money even if it’s a small amount?

Absolutely. Even small savings can build up over time and provide a financial buffer for unexpected expenses or financial emergencies.

How can I resist the urge to spend my savings?

Keep your savings in a separate account that’s harder to access, like a high-yield savings account or a certificate of deposit. This creates a psychological and logistical barrier against spending.

What’s the best way to save for a large purchase?

Set up a dedicated savings account for the purchase and contribute a fixed amount monthly. Tracking your progress can also be motivating and help you stay on target.

These headings and structured answers provide a clear and organized approach for readers to quickly find and understand tips for improving their saving habits.

Conclusion in tips for saving money monthly

Saving money each month requires discipline, planning, and a bit of creativity. By understanding your spending, setting clear goals, and making thoughtful changes to your lifestyle, you can improve your financial health. Implement these tips for saving money monthly and watch your savings grow, empowering you not just to survive but thrive financially.